WPX will execute on changes made in 2015, 2016

After its transformational years of 2015 and 2016, WPX Energy (ticker: WPX) plans to take advantage of its Delaware basin opportunities in 2017 and 2018. During the challenging environment of the downturn, WPX made many changes to reposition itself. In 2015 the company transitioned from a gas-heavy asset base, with only 30% composed of oil and NGLs, to a much more oily company in 2016, with 62% of assets composed of oil and NGLs in Q1 2016.

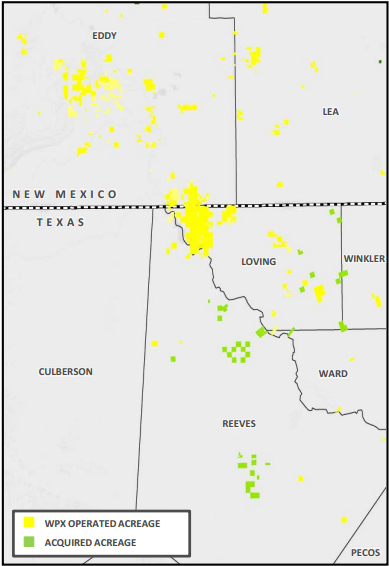

WPX’s $1.5 billion acquisition of RKI in July 2015 gave the company a major presence in the Permian, and since then WPX has taken advantage of several opportunities to grow in the Delaware basin. Most recently, WPX acquired Panther Energy and Carrier Energy, adding 18,100 net acres for $775 million. Excluding existing production, this deal had an acreage cost of ~$28,500/acre. This price is far less than many other companies recently paid for Permian acreage, where $40,000/acre is the going rate more than not.

In 2017 WPX plans to “start growing our cash flow and production and do it with a very orderly and economic approach,” WPX IR Head David Sullivan told Oil & Gas 360®.

Sullivan said that the goal is to use operating cash flow and cash on hand to grow production and cash flow and reduce leverage. The current plan is to get net debt to EBITDAX to approximately 2.0x by year-end 2018.

WPX tests 16 wells per pad in Wolfcamp

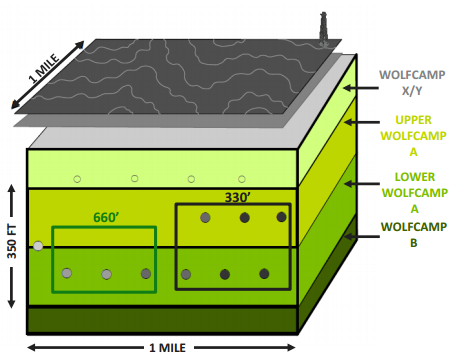

With an expected 7 rigs operating in the Delaware after the close of the Panther acquisition, WPX has strong potential to grow production in the next two years and beyond. The company plans to focus on the Wolfcamp X/Y and A, but with 11 proven productive zones in the Delaware basin there is tremendous opportunity available.

Delineation work is planned for the Wolfcamp C in 2017, with additional delineation of the B expected in the future. Spacing tests are also in progress in the Wolfcamp A, where 80 acre spacing is under consideration. If successful, this spacing program would allow 16 wells per drilling unit in the Wolfcamp A alone.

WPX has made significant improvement in its Delaware basin well designs. When the RKI acquisition closed, “a Wolfcamp A was a $7 million well, with 670 EUR. Now we’re talking approximately $5 million for a one-mile lateral, million barrel well.”

WPX will be presenting its story at the Tower Club Downtown Dallas on Wednesday, March 1, as part of EnerCom Dallas, an investor conference which is modeled after EnerCom’s The Oil & Gas Conference® in Denver.

The Dallas conference is designed to offer investment professionals a unique opportunity to listen to a wide variety of oil and gas company senior management teams update investors on their operational and financial strategies and learn how leading independent energy companies like WPX are building value in 2017.

The forum offers healthy dialogue and informal networking opportunities for attendees.

To sign up for EnerCom Dallas and hear WPX, or to find out more information about presenting companies at EnerCom Dallas, click here to visit the conference website.