Oil Price Slide, Lower Exchange Rates Force Balance Sheet Adjustment

2015-2019 Plan is $125 Billion Lower than 2010-14 Plan

The past year has been one to forget for Petrobras (ticker: PBR), as Brazil’s state owned oil magnate moves on from a messy scandal that has revealed some of the most prominent figures in the government.

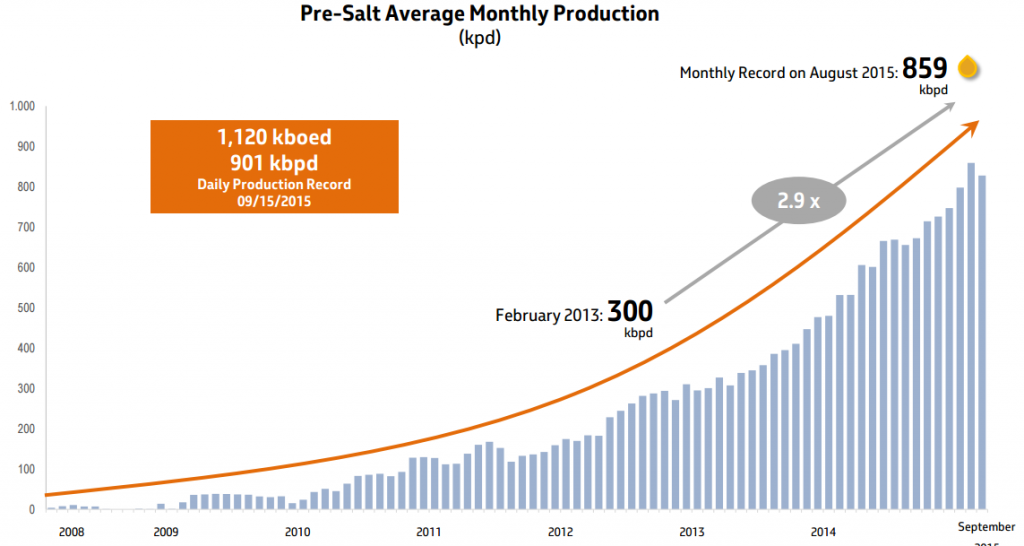

Aside from the proverbial black eye that has been well-documented by the media, PBR bears some basic similarities to its fellow exploration and production companies. For one, the company produced more in 2015 than any year before (2,128 MBOPD, up 4.6% from 2014) and is straddled with significant debt. In fact, Petrobras is currently the most indebted oil company in the world, with more than $127 billion in liabilities as of Q3’15.

As if things couldn’t get worse for PBR, the company is coping with $30 oil prices and a Brazilian real that is rapidly depreciating against a strong American dollar. Brent oil prices at the close of market on January 12, 2016 are 46% below the opening price of 2015 ($30.85 from $57.33). Similarly, the real has depreciated by 52% in that same time frame (2.65 from 4.02), surpassing 20-year lows.

The New Five Year Plan

Petrobras first released details on its 2015 – 2019 business plan in June 2015 but cautioned that adjustments could be made, pending a depressed commodity environment.

Those adjustments (the second in seven months, including a minor tweak in October) came to light in a January 12 news release. According to PBR management, the company plans on spending $98.4 billion through 2019 – down nearly 25% from initial targets of $130.3 billion. Previous adjustments included reducing expenditures in the short term, but the latest modification extends throughout the life of the five year plan.

Previous adjustments from October dialed back production estimates by 30%, expecting 2020 volumes to hit 3,700 MBOPD from 5,300 MBOPD.

A Sea Change

It’s worth noting the company’s previous five year plan from 2010 to 2014 listed investments at $224 billion – more than double the latest plan. PBR successfully raised $70 billion in 2010 to fund the proposal. Amazingly, Petrobras was forced to cancel a $0.8 billion bond sale in October 2015 due to a lack of interest. The average annual price per share of Petrobras in 2010 was $37.84, and its balance sheet at year-end consisted of less than $70 billion in debt.

Acquisitions will not be in the fold in the near term – management is attempting to sell as much as $58 billion in assets to chip away at its monumental debt. An estimated $15.1 billion are aimed to be divested by year end 2016, although only $0.7 billion have been sold to date. More than $17 billion was written off in its Q4’14 results.