It’s like being in the Midland, but with better financial terms – TransAtlantic discusses its operations in Turkey

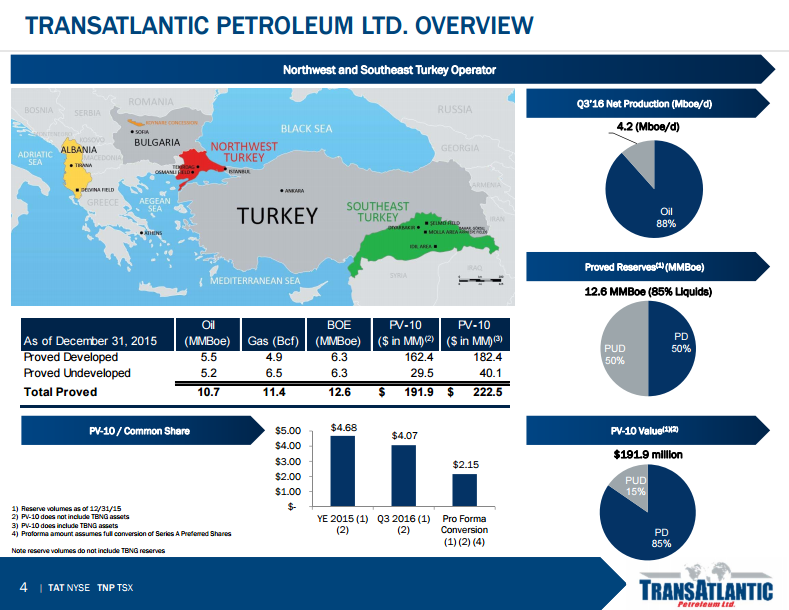

The last nine years have been marked by explosive growth in the North American oil and gas sector, but many companies continue to exploit hydrocarbon resources successfully in other parts of the world as well. TransAtlantic Petroleum (ticker: TAT) is one such company, with operations in Turkey, Albania and Bulgaria, and some of the well results reported by the company have outperformed those in some of the most prolific plays in the United States.

“These are high net-revenue, large contiguous lease blocks at the center of a petroleum basin, which would be similar to being in the center of the Midland Basin,” TransAtlantic Chairman and CEO Malone Mitchell III told Oil & Gas 360® speaking about the company’s assets in Turkey.

“The blocks are 87.5% net revenue, so they actually have better fiscal terms than you have in the U.S., as well,” Mitchell said.

In December, the company drilled its Bahar 11 well, offset to the Hazro F-3 well, which had an initial production (IP) rate of 1,826 BOPD, according to a TAT presentation.

“The wells we drill in Turkey are outperforming some drilled in the STACK,” said Mitchell. “I’m not saying these STACK wells are bad, but the wells drilled in Turkey have better economics.”

The Harzo F-3’s IP rate did outperform many wells drilled in the STACK by companies like Continental Resources, Apache and Vitruvian, according to a Marathon Oil comparison of operations in the STACK play.

What is the degree of political risk?

Speaking on concerns associated with operating in other parts of the world, Mitchell said the news coming out of the region is often sensationalized. “There is a very stable governmental and regulatory framework in place,” he said. “it’s viewed poorly outside of the country because people don’t know much about it, but in the oil and gas industry it has been very stable for over 50 years.”

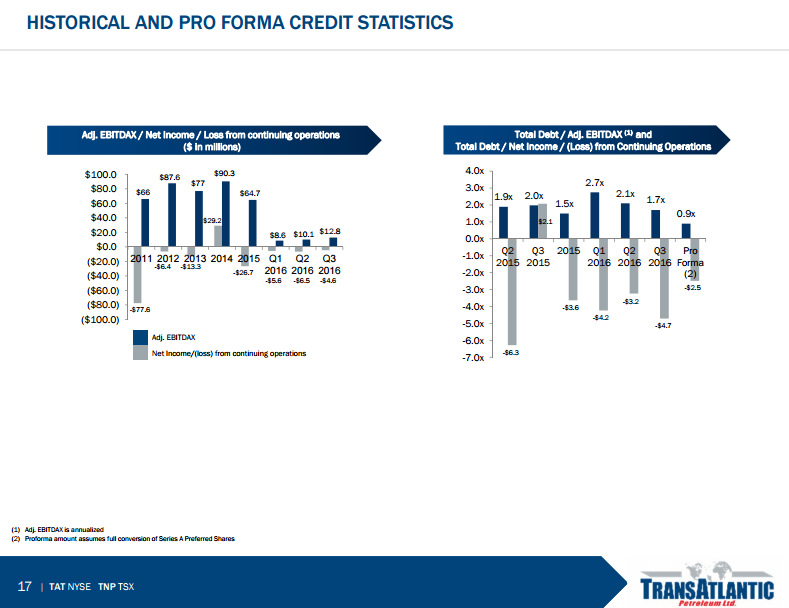

Debt has been reduced 75% through the downcycle

Like oil and gas companies everywhere, TransAtlantic was affected by the drop in oil prices. Lower commodity prices halted drilling for a time, but TransAtlantic was able to pay down debt by 75% during the course of the downturn, leaving the company in an excellent position moving forward, explained Mitchell.

“We have been mindful of our balance sheet [over the course of the last year]. We didn’t go through bankruptcy, and we did not discount our debt. We reduced our debt from about $150 million to about $20 million.

Horizontal stimulation

“We’re now employing horizontal stimulation to wells that have been very productive on a vertical basis, and we expect to drill several, significant step-out exploratory wells, which will expand our proven-producing trend and increase our resource base.”

TransAtlantic presenting at EnerCom Dallas

TransAtlantic Petroleum will be presenting its story at the Tower Club Downtown Dallas on Thursday, March 2, as part of EnerCom Dallas, an investor conference which is modeled after EnerCom’s The Oil & Gas Conference® in Denver.

The Dallas conference is designed to offer investment professionals a unique opportunity to listen to a wide variety of oil and gas company senior management teams update investors on their operational and financial strategies and learn how the leading independent energy companies are building value in 2017.

The forum offers healthy dialogue and informal networking opportunities for attendees.

To sign up for EnerCom Dallas and hear TransAtlantic, or to find out more information about presenting companies at EnerCom Dallas, click here to visit the conference website.