Elk Petroleum announces capital raise to fund low-cost growth

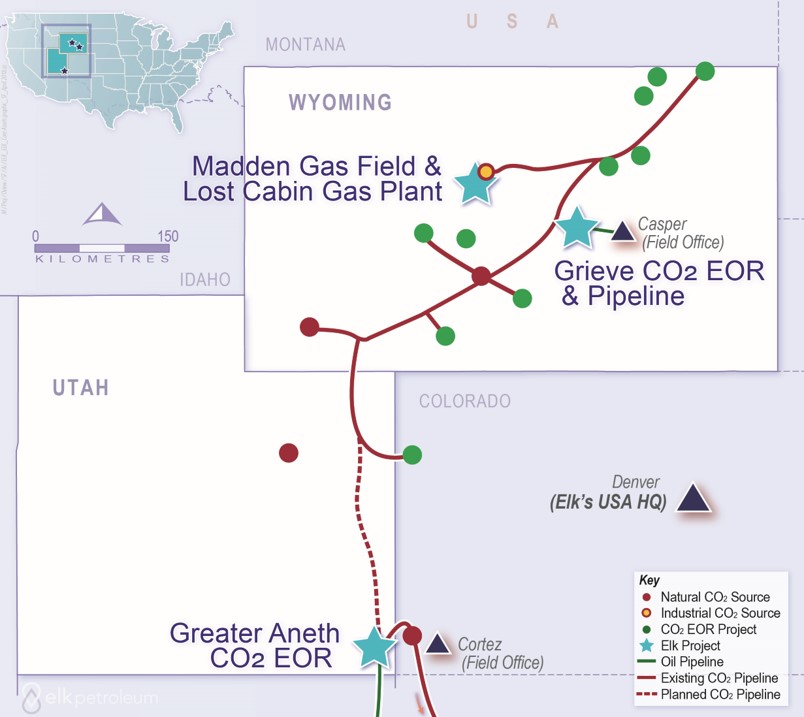

Elk Petroleum (ASX: ELK) announced today that the company successfully completed a A$13.5 million (US$10.2 million) private capital raise which will help the company continue to reinvest in its low-cost, low-decline Aneth CO2 EOR assets that were purchased from Resolute Energy (ticker: REN).

The company has identified a significant range of low-risk development projects aimed at significantly increasing production and developed reserves in the Aneth Oil Field, Elk said in its ASX announcement. The proceeds from the placement will go toward operations at Aneth field in 2018, the company said.

Elk said projects at Aneth will commence in June, starting with the McElmo Creek Unit DC-IIC well deepening program and the McElmo Creek Unit Compression Expansion project.

The total capital expenditure for the well deepening program is approximately US$4.6 million net to the company and is expected to add 2.2 MMBO of 1P PDP Reserves and peak additional production of approximately 1,000 BOPD net to the Elk. Total capital expenditure for the McElmo Creek Unit Compression Expansion project is approximately US$10.4 million and is expected to add 2.6 MMBO of 1P PDP Reserves and peak additional production of approximately 600 BOPD.

Elk adding to reserves for 4x less than average deals, and adding production 20x below YTD averages

Thanks to the low-cost nature of the projects, Elk will be adding 1P PDP Reserves for an average of $3.05 per barrel across the two projects, and adding flowing production at an average of $10,966.67 per barrel, well below average.

Based on M&A transactions to take place year-to-date with publicly available metrics, the average price per barrel of 1P reserves is $16.17 and the average for a flowing barrel of oil is $92,011.25 per barrel, more than 4x and 20x higher than Elk’s increases, respectively.

At $60 WTI flat oil price, the well deepening and the compression expansion projects are expected to increase the 1P PDP PV10 of the Aneth Oil Field by approximately US$35.5 million and $21.3 million, respectively, the company said. The company is focusing on increasing 1P PDP Reserves at Aneth by over 60% and production by 25% by late 2019. The increased reserves will offer greater access to capital as the company looks to strengthen its balance sheet, and production on its low-decline assets will continue to generate capital for Elk.