DOJ sues Halliburton over antitrust concerns in Baker Hughes acquisition

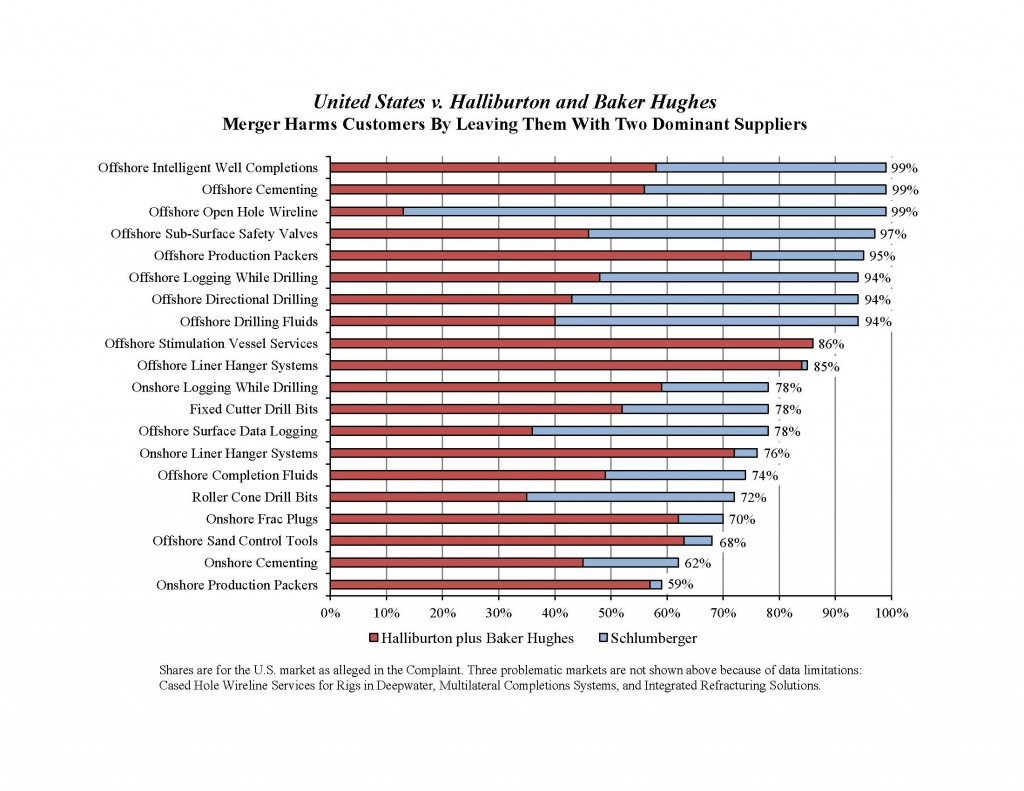

The Department of Justice today announced that it will sue Halliburton (ticker: HAL) over its planned $34 billion takeover of its next largest oilfield service competitor, Baker Hughes (ticker: BHI), over antitrust concerns. The combination of Halliburton and Baker Hughes would leave the combined company and Schlumberger (ticker: SLB) as the two dominant forces in many critical oilfield service sectors, creating a duopoly, according to the DOJ.

Bill Baer, the head of the Justice Department’s antitrust division, said the deal is “unfixable” and assailed the companies for proposing “the most complicated array of piecemeal divestitures and entanglements” that he has ever seen.

“Competition in the oilfield services industry is critical to our economy,” he said on a call with reporters after the suit was filed. “Competition leads to safer ways to extract oil and gas, to more efficient methods for drilling and it keeps down the cost of producing a barrel of oil. The American public cannot be asked to bear the risk that these benefits will be lost.”

Halliburton and Baker Hughes said they plan to contest the case and move toward completing a merger. Some cases brought forward by the government are settled when companies agree to sell assets to resolve competition concerns, but Baer has been aggressive in fighting large mergers in industries as diverse as beer and airlines, reports Bloomberg.

Baer called the divestitures already announced by the company a “grab bag” of business that was “so complicated and convoluted” it would turn the antitrust division into an energy-sector regulator.

Letting the deal fall through may be the best course forward

With the tremendous amount of pushback Halliburton and Baker Hughes have received from antitrust regulators, both in the U.S. and abroad, many have begun to ask the question: would it be so bad if the deal failed?

Halliburton shares rose 6.4%, the biggest gain since August, while Baker Hughes rose 9.3%, the most since November 2014, following news of the impending lawsuit, reports Bloomberg.

Notes from a number of analysts today also pointed out that, while the two companies are certainly smaller separately, they may be in better shape on their own than combined. With an upcoming optional termination date approaching, the deal could fall through in the near future.

A note from Raymond James today said Halliburton remains positioned for a recovery in oil prices. “Halliburton’s growth prospects are one of the strongest given its outsized exposure to U.S. pressure pumping, which should be first to recover,” said Raymond James.

Baker Hughes also stands to gain from the deal in a very real way. The $3.5 billion termination fee would go a long way in revitalizing the company’s idled equipment and paying down its debt. Raymond James believes the termination fee would leave the company with a $600 million pro forma net cash position.

The market has already priced in the merger’s failure, said Raymond James, leaving very little downside to the companies remaining the way they are.

Could the deal’s failure launch more M&A?

A note from Stephens today pointed out that the deal would leave BHI with capital to execute its own acquisitions, and HAL potentially on the prowl for other, smaller targets. The end of the Halliburton/Baker Hughes merger would, in Stephens’ opinion, “spur industry wide consolidation.”

Stephens highlighted several targets that might make attractive additions to BHI’s current business, particularly on the technology side of production enhancement. Halliburton, on the other hand, looks like it will be relatively unaffected by the termination due to conflicting feelings among investors regarding the quality of the deal, Stephens said in its report.

In early March, Brian Uhlmer, GMP Securities managing director, told Oil & Gas 360® he thought the deal was dead. Because of the EU pushing back, Norway against it, the U.S. demanding divestitures and other forces pressuring the deal, Uhlmer said he didn’t believe the Halliburton-Baker Hughes merger would ultimately go through.

Uhlmer said he believed the oilfield service industry was becoming technology-driven, and he expected to see Silicon Valley style incubators creating a world of new technologies for oil and gas. “It’s going to be a tighter market in the next 3-5 years; the technology angle is evolving; offshore and subsea services will evolve. The parts of the industry that make it will be differentiated by technology.” He described Weatherford as a commoditized service provider, where HAL, BHI and SLB are technology differentiated.