Light oil from shale likely to become 70% of U.S. production

The shale revolution has transformed the type of oil the U.S. produces. It’s a process that will continue in the near future according to the EIA and just about every other agency that keeps tabs on production trends.

Unconventional shale deposits generally hold light, low sulfur grades of oil, and production from these fields is exclusively light sweet oil. Plays that produce heavier oil have been eclipsed by rising shale production, and heavier oil grades have been roughly flat in recent years.

Heavier oil is produced from three main locations in the U.S.—California, Alaska and the Gulf of Mexico. While new projects in the Gulf have led to production in that region increasing, Californian production is on a slow decline that is unlikely to return to growth at any significant scale.

While Alaskan activity has improved, with the return of M&A and new land opened up for drilling, the northern most U.S. state has been overshadowed by basins like the Permian, where new oil is very close to established markets and operations.

The Permian, Bakken and all other shale plays are major sources of light oil production, and will likely continue to grow in the coming years. This oil has turned the American energy environment upside down, transforming imports, exports and everything in between.

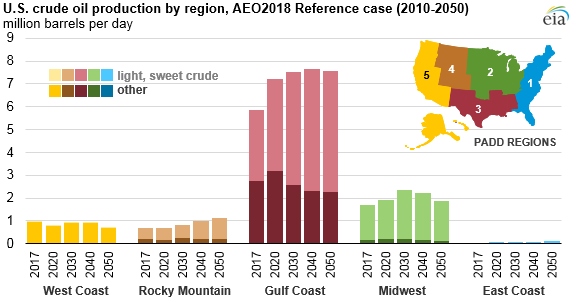

The EIA predicts this trend will continue, as production from shale plays continue to rise. While light sweet crude accounts for 56% of current production, the agency’s Annual Energy Outlook predicts this share will grow to 60% by 2020 and 70% by 2050.

Permian’s size and scale mean it will dominate new production

Unsurprisingly, the majority of new growth is expected to come from PADD 3, which are in the region that the EIA labels ‘Gulf Coast’. The Gulf Coast region includes the Permian and Eagle Ford and both plays still have vast amounts of oil left to produce. PADD 3, which includes Texas, New Mexico, GOM offshore and most of the other Gulf Coast states, is expected to produce about 7.5 MMBOPD by 2040.

The EIA also predicts significant growth from the Midwest, essentially from the Bakken and SCOOP/STACK. However, these formations do not have the massive extent or reserves of the Permian, so the EIA predicts that production from the Midwest will rise through 2030, then gradually fall. The EIA also predicts growth from the Rocky Mountain region, though not at the scale of the Gulf or Midwest. However, the agency believes formations like the Niobrara and Powder River Basin have more room to grow, and will increase production through 2050.

Depending on technology advancements, light oil production could range from 4 MMBOPD to 15 MMBOPD

Of course, these results are highly dependent on the growth of technology and how much oil is ultimately recoverable.

The EIA has published estimates for different situations, showing very different futures for the American oil and gas industry.

From 20 MMBOPD to 7 MMBOPD: the wide swing in the prediction for U.S. production – where it lands depends on whether technology advances or not

If oil and gas technology continues improving rapidly and makes producing larger amounts of oil possible, shale operations are likely to see the highest benefit.

In this case, total American oil production could rise to nearly 20 MMBOPD, primarily driven by shale output. In this case, the EIA predicts that light sweet oil from the Permian and other shale fields could account for 76% of total production.

On the other hand, if there are minimal advances in technology and recoverable reserves prove lower than expected, shale is also likely to be heavily affected. In this case, total oil output is expected to fall to about 7 MMBOPD, with both conventional and unconventional production declining. While the proportion increases in intermediate periods, the EIA predicts that by 2050 light sweet oil would return to its current level, 56% of overall production.

It’s also worth noting that the price of oil generally has a major effect on where U.S. production levels end up.