CDEV Chairman Mark Papa says tepid U.S. production growth due to running out of Tier 1 drilling locations in 2 of the 3 biggest U.S. oil basins

Centennial Resource Development (ticker: CDEV) reported Q3 earnings today and CDEV Chairman and CEO Mark Papa took the occasion to express his observations about the actual reasons for a drop in growth of overall U.S. oil production.

“Based on monthly EIA numbers, U.S. oil production has been essentially flat for the past seven months,” CDEV CEO Papa said, “and I expect 2017 year-over-year production growth to be 330,000 barrels per day, much less than earlier consensus estimates of 700,000 to 800,000 barrels per day, even though the oil rig count is currently 900, an increase of 500 rigs compared to May 19, 2016.

“Many people ascribe the reason for this tepid growth to be cash flow or service company limitations, but I think it’s lack of remaining Tier 1 geologic-quality drilling locations in two of the three major oil shale plays, the Eagle Ford and Bakken.

“Even in a constructive oil price environment, I expect the 2018 total U.S. oil growth will be considerably less than the 1.2 million to 1.4 million barrels per day that many people are predicting,” Papa said.

Conference call Q&A

Q: There have been several large Bakken operators that have announced improved well results in the quarter. That is to say, they have upwardly revised their EURs. So, how do you think we should view those improved results in the context of the Bakken running low on Tier 1 locations?

CDEV: I think in both the Bakken and Eagle Ford you’re going to continue to hear of individual successes and individual well results by individual companies, and in no way am I saying that you won’t still have individual successes in the Bakken and Eagle Ford. But I think if you look from the 30,000 foot level at the Bakken and Eagle Ford overall, I would say that they are no longer the growth engines that they were four or five years ago, and that the majority of the Tier 1 quality locations have been drilled and there are just not that many to go.

And if you suddenly got to an old price environment that, let’s just say, turns out to be $70 WTI and you pump a lot of capital into the Bakken and Eagle Ford, the result in production growth that you’re going to see from current levels in those assets, I predict, is going to be disappointingly low. But clearly, you have individual wells from time to time that will be successful.

Q: Cycle times are deteriorating due to overall service quality and less experienced crews. Given the strength of your operations, could you comment on what you guys are doing to counter some of these forces?

CDEV: I think that is certainly something we focused on, keeping your crews happy out there, getting experienced folks, getting to the job site safely, and treating them properly keeps them motivated. I think we’ve done a good job of engaging and retaining top tier talent in the field. We haven’t seen any real loss either on our rigs or on our dedicated frac crew. So we’re happy with the crews and their performance, and we continue to see good things come from them.

As companies find that volumes are disappointing, the blame may fall on service companies. You might hear that service company quality deteriorates or the unavailability of service company crews. And my advice to you is, if you filter through that, well yeah, there’s certainly an element of truth in all of that.

Masking the underlying culprit

But I think it may be masking the underlying culprit, and the underlying culprit is likely lack of tier 1 geologic quality drilling locations and fundamental lesser quality drilling results. And so, it’s going to be up to you people to ferret out, is it really the service industry that’s causing the bottlenecks for disappointing production, or is it that the reservoirs themselves are not yielding the aggregate production that people had expected? And is that why the overall monthly EIA numbers are showing less than expected results?

Not saying future U.S. production growth will be flatline

And again, one more comment going back to the macro view, I am in no way saying that I expect future production growth in the U.S. to be flatline. I expect to see production growth in the U.S. continue to increase. But I just expect that increase to be more tepid than many people are predicting. So it’s just something that I would suggest you keep an eye on over the next 6 to 12 months and monitor it for yourself as the monthly EIA numbers come out. And I would suggest you don’t pay much attention to the weekly EIA production numbers because they’re not that accurate.

Q: Your original plan added one or two rigs per year. Is that still the case?

CEO Papa: If you go back a year ago, we had a fairly aggressive ramp-up in the number of drilling rigs by the time we got to 2019 and 2020. And it’s fair to say that the drilling rig efficiencies have allowed us to project that we’re going to get to 60,000 barrels a day with less rigs than we would have projected a year ago.

So clearly, we’re drilling the wells faster than we would have projected a year ago. And so we’re going to get the 60,000 barrels a day with less rigs. We’re not yet prepared to give you a forecast for where we’re going to be in 2018 on the number of rigs, but it is reasonably certain that we will be adding rigs over the number of six in 2018.

Q: Your first Lea County well is in the second Bone Spring Sand. I’m wondering is this going to continue to be the primary zone now that Lea is attracting a rig or do you have some others in mind?

COO Smith: That first well we drilled was in the second Bone Spring Sand target interval that is definitely a primary producer across our entire acreage position. Although, I think we have announced before that we’ve got first Bone production on our acreage, as well as several other zones in and around our acreage. So, I think it will be a mix of first, second Avalon, and possibly some third and even Wolfcamp into the first part of next year. So, multiple zones in New Mexico.

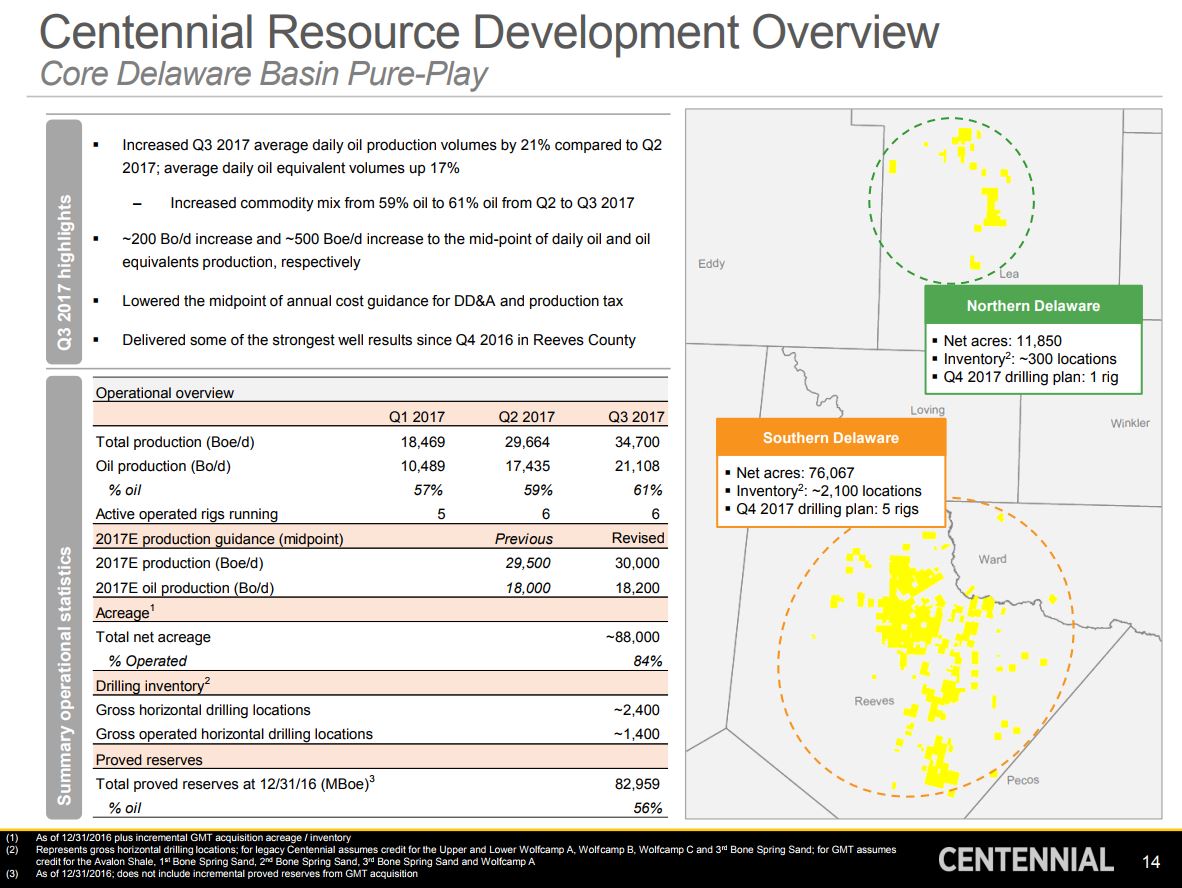

Centennial Resource Development (CDEV) Q3 highlights

- 21% crude oil and 17% total company daily production growth, compared to Q2 2017

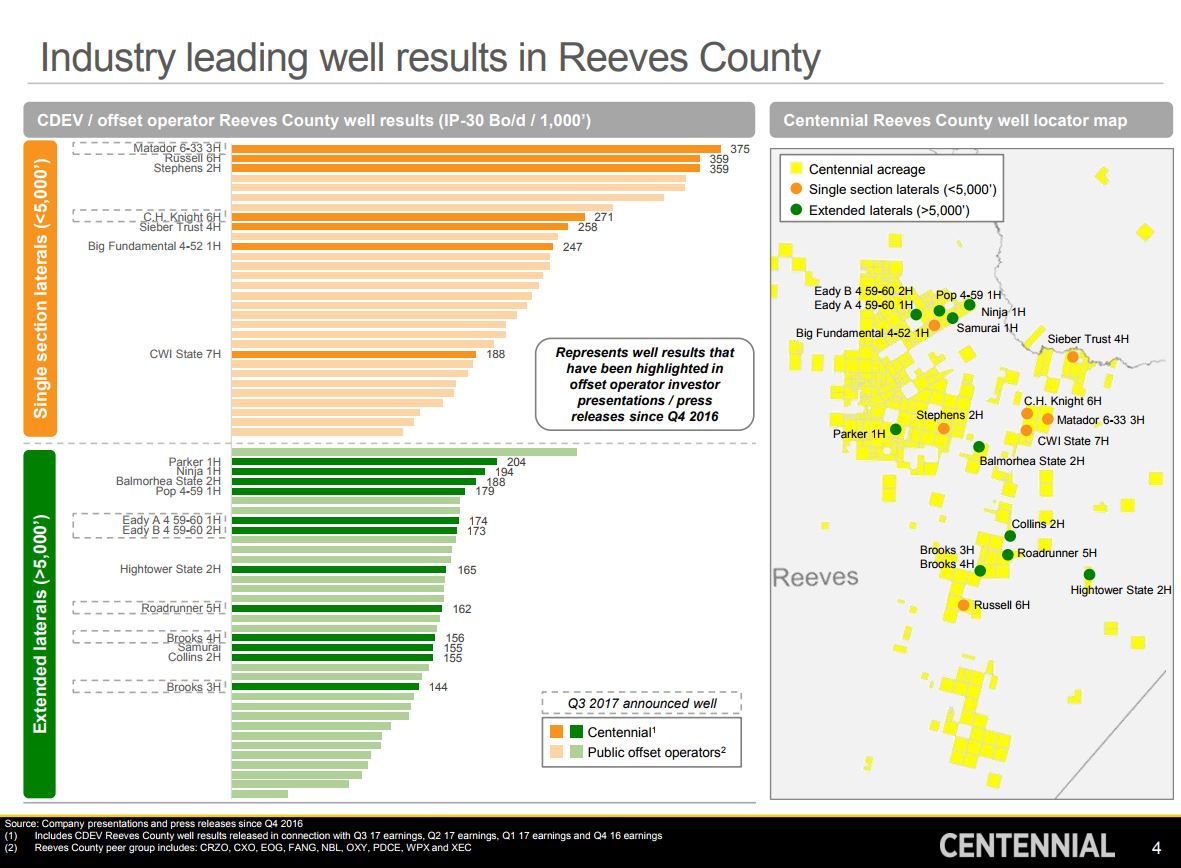

- In Reeves County, the Brooks 3H, 4H, and Roadrunner 5H wells were completed

- 20% longer laterals in Q3, compared to Q2

- 13 wells completed so far, an estimated 25 wells to be completed in Q4

For Q3, Centennial Resource Development reported net income of $14.4 million, or $0.06 per share. This compares to a net loss of $5.1 million in Q3 2016. Centennial incurred approximately $180 million of total capital expenditures during Q3, of which approximately $163 million was related to drilling and completions.

Southern Delaware Basin Operations

In the Southern Delaware basin, Centennial completed the Matador 6-33 3H (72% WI) in the Upper Wolfcamp A, which had an initial 30-day production rate of 2,154 BOEPD (74% oil). The well had an effective lateral of approximately 4,300 feet with an initial 30-day production rate of 375 barrels of oil per day per 1,000 foot of lateral.

Also in the Upper Wolfcamp A, the C.H. Knight 6H (95% WI) was drilled with an approximate 4,400 foot effective lateral and produced 1,620 BOEPD (73% oil) for the initial 30-day production period. On a per lateral foot basis, the well delivered an initial 30-day production rate of 271 barrels of oil per day per 1,000 foot of lateral.

Centennial Resource Development Chairman and CEO Mark G. Papa said, “The Matador represents our most productive well to date on a per-lateral-foot basis and has produced over 100,000 barrels of oil during its first ninety days on production.”

The technical team is now in the late stages of frac optimization, including the effective implementation of proppant intensity and refining the number of clusters per stage.

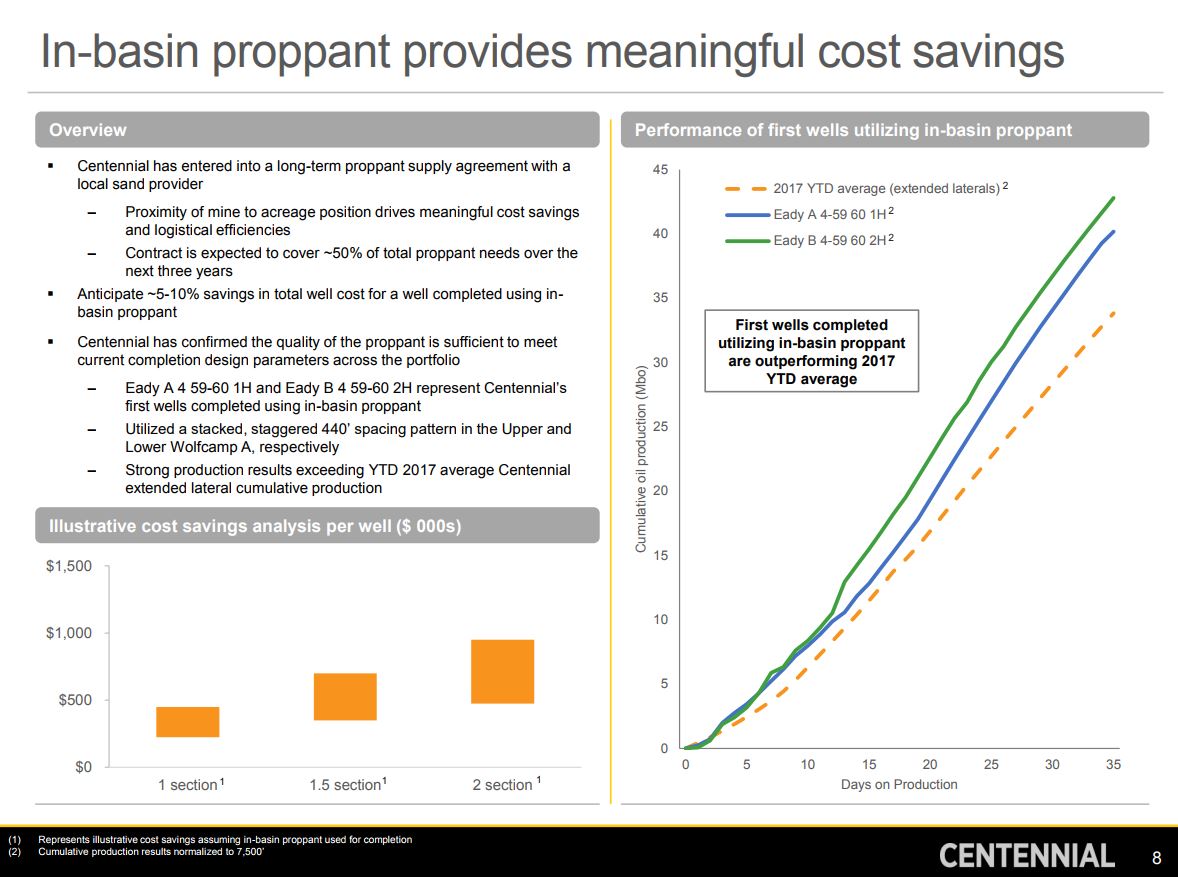

Contract with local sand provider helps CDEV lower operating costs

During Q3, Centennial executed a long-term proppant supply agreement with a local sand provider. The Eady 4 59-60 1H and 2H were the first wells completed using the new in-basin proppant. Drilled on Centennial’s Silverback acreage in Reeves County, the wells were drilled using a stacked, staggered pattern in the Upper and Lower Wolfcamp A, respectively, with an average 6,800 foot effective lateral.

The Eady A 4 59-60 1H (97% WI) had an initial 30-day production rate of 2,166 BOEPD (56% oil), with 1,222 barrels of oil per day. The Eady B 4 59-60 2H (97% WI) had an initial 30-day production rate of 1,915 BOEPD (60% oil), with 1,142 barrels of oil per day.

“The use of in-basin proppant will provide Centennial with meaningful cost and efficiency savings in the future,” CEO Papa said. “With our current completion design, we estimate well cost savings of five to ten percent per well with this sand. The ability to source sand locally will also help minimize transportation and logistical delivery matters.”

The contract will supply approximately half of Centennial’s expected proppant needs over the next three years. The additional sand options reduces the risk of any potential sand disruption. The completions team has been working to ensure that the size and crush strength is enough to effectively stimulate the reservoirs.

New Mexico and other plans

Centennial also reported its first well from Lea County, New Mexico, in the heart of the Northern Delaware Basin. Targeting the 2nd Bone Spring Sand, the Romeo 1H was drilled by the previous operator and completed by Centennial’s technical team. The well had an effective lateral of approximately 4,200 feet and delivered an initial 30-day production rate of 1,316 BOEPD (84% oil), with 1,105 barrels of oil per day.

Centennial plans to operate a six-rig drilling program for the remainder of the year. Plans are underway to further delineate acreage across the recently acquired GMT and Silverback positions. In addition, Centennial will evaluate the potential for downspacing and test additional zones across its acreage blocks.

Operations Summary

- Average oil production was approximately 21,100 barrels per day in Q3

- Average oil equivalent production for Q3 totaled approximately 34,700 barrels per day

- Midpoint oil production guidance at 18,200 barrels per day and total equivalent midpoint at 30,000 Boe per day

- Averaged approximately 2,500 pounds of proppant per lateral foot and 15 clusters per stage, a 30% increase in proppant per foot and 70% increase in clusters per stage over vintage completion designs used during the end of last year

In house geo-steering drills record well

Centennial COO Sean Smith said, “Year-to-date, Centennial’s in-house geo-steering department has steered approximately 60 wells and has remained in our 30-foot target window approximately 95% of the total lateral. During the third quarter we drilled our record well in 12.6 days spud to total depth. This was a single mile lateral.”

Mark Papa has served as chairman and CEO of Centennial Resource Development since October 2016. Prior to that, he was chairman and CEO of Silver Run Acquisition Corp. before its business combination with Centennial Resource Production, LLC. Also an advisor at Riverstone, before joining Riverstone and Centennial in February 2015, Papa served as chairman and CEO of EOG Resources, Inc. (NYSE: EOG), from August 1999 to December 2013.