Acquisition makes Parsley second largest publicly traded E&P in the Midland basin

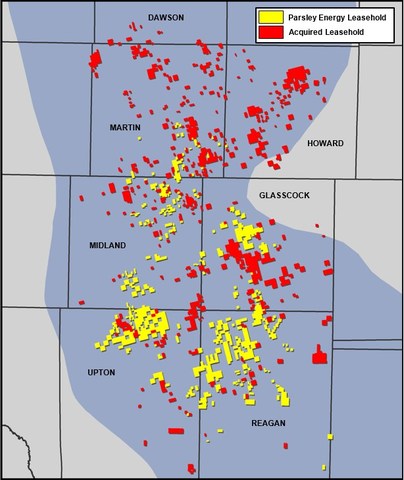

Parsley Energy (ticker: PE) announced the acquisition of 71,000 net acres in the Midland basin for $2.8 billion today, increasing its Permian acreage by 45%. The acreage will be purchased from Double Eagle Energy, a private land-centered E&P company. Including this acquisition Parsley’s total Midland basin acreage is 179,000 net acres, and Permian acreage is 227,000 acres.

Parsley will fund the acquisition with $1.4 billion in cash and 39.4 million units of Parsley Energy valued at $1.4 billion. The cash portion of the purchase will be financed with equity and debt offerings. With a per-are cost of approximately $37,400, this deal is far from the highest acreage valuation seen in the Midland basin. The acquisition gives Parsley the second largest Midland basin net acreage among publicly traded E&P companies.

Acquisition Highlights

- Approximately 71,000 net leasehold acres

- Estimated net production of approximately 3,600 Boe per day as of January 1, 2017

- 23 drilled uncompleted wells, variously targeting the Lower Spraberry, Middle Spraberry, Wolfcamp A, and Wolfcamp B formations, with an average lateral length of approximately 8,400 feet, valued at approximately $75-100 MM in aggregate

- Approximately 3,300 net horizontal drilling locations, including approximately 1,800 net locations in high priority target intervals (Lower Spraberry, Wolfcamp A, Wolfcamp B)

- Average lateral length of approximately 6,600 feet on acquired horizontal drilling locations; more than 40% of acquired horizontal drilling locations have lateral lengths of 7,500 feet or more

- Operating control on 80% of net horizontal drilling locations

- Incremental value potential through ongoing acreage trades, bolt-on acquisitions, and working interest buyouts; Double Eagle to assist with asset operation and handoff, as well as acreage trades and purchases after closing

- Scheduled to close on or before April 20, 2017, subject to the satisfaction of customary closing conditions

Acquisition increases 2017 rigs

Parsley also released updated 2017 capital guidance, as the purchase adds more opportunity for development. The acquisition will increase CapEx substantially to $1 to $1.15 billion, from $750 million to $950 million before the purchase. Parsley expects to complete 130 to 150 wells in 2017. Previous guidance indicated 10 rigs active through 2017, but the purchase has allowed 11 rigs in Q2, 12 in Q3 and 14 in Q4. The company believes that this acquisition gives it an acreage footprint large enough to support a 20 rig drilling program.

Parsley also released reserve estimates for 2016, showing a strong increase over 2015. Proved reserves increased 80% to 222.3 MMBOE from 123.8 MMBOE last year. Notably, the company removed all reserves associated with potential vertical well activity, decreasing reserves by 18.4 MMBOE in the move.

Permian basin feeding frenzy

The Permian has become a hot spot for acquisitions in recent months, as several big players have bought acreage in the basin. ExxonMobil (ticker: XOM) made a massive $6.6 billion purchase last month, buying 275,000 acres from the Bass family. Noble Energy (ticker: NBL) purchased Clayton Williams Energy for $3.2 billion in January, and WPX (ticker: WPX) acquired Panther Energy and Carrier Energy for $775 million. Parsley Energy already joined in the feeding frenzy in early January, purchasing 23,000 acres for $607 million.