More Hz Drilling in Cotton Valley and Woodford with a Gulf Coast Catalyst around the Corner

In a non-deal roadshow in mid-October, PetroQuest Energy (ticker: PQ) executives told investors and analysts that they expected the company would end 2014 with record production and reserves. After reporting its Q3’14 and nine months results, PQ appears to be on track to meet its estimates.

For the first nine months of 2014, PetroQuest reported net income available to common stockholders of $24,306,000 ($0.37 per share) compared to $6,652,000 ($0.10 per share) for the 2013 period. Discretionary cash flow was $100,079,000 for the first nine months of 2014, as compared to $65,158,000 for the first nine months of 2013.

Q3’14 production 11.6 Bcfe is the highest in company history. For the first nine months of 2014, production was 32.1 Bcfe, compared to 27.8 Bcfe for the comparable period of 2013. Oil and NGL volumes made up approximately 30% of third quarter 2014 production as compared to 23% in the third quarter of 2013. Oil and gas sales on nine-month basis have increased by 36% year over year.

Earlier in the year, PetroQuest management expressed three key objectives for 2014. Here’s how they stack up at this point in the year:

2014 Goal #1: De-risking Cotton Valley

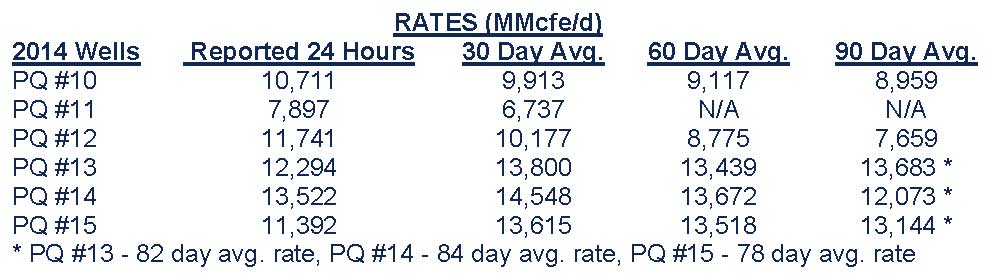

The company’s first major goal was de-risking a multi-zone Cotton Valley (East Texas) acreage position that currently holds more than 200 drilling locations. The company itemized drilling and completion results from six horizontal Cotton Valley wells in its Q3 earnings release this week. The following table summarizes the extended gross production (MMcfe/d) from each well:

Ryder Scott, a third party engineering firm, gave five wells EURs of approximately 9 Bcfe per well, “greatly exceeding our pre-drill expectations,” said Charles Goodson, PetroQuest’s Chairman and CEO, during the company’s Q3 investor call.

Goodson continued: “From a cost standpoint, we used $6.8 million in average well costs based on historicals for our economics. The cost of our last three wells was $6.2 million. Combining recent well costs with third party EURs sets up a very attractive play with potential F&Ds of less than $0.75 per Mcfe.”

“As we begin a continuous and uninterrupted 2015 plus program, we expect to see further reductions in service cost levels. We’re moving a rig back in the field this week to start the 2015 program. We will spud the PQ #16 with 100% working interest. With only six new Cotton Valley wells contributing, we grew our total Carthage field reserves and production by a staggering 94% and 195% respectively from year end 2013.”

During the Q3 conference call, an analyst asked about allocating capital to the Cotton Valley assets. “It’s definitely going to continue to get a higher allocation of capital based on these results. From a consistency standpoint, it’s generating the best rates of return. I think even with a softer oil market and a little softer NGL market, we’re still showing rates of return anywhere from 55% to 70% right now, depending on where – if we can keep these well cost around $6 million. So, it inherently is going to start getting more money,” said Todd Zehnder, Chief Operating Officer.

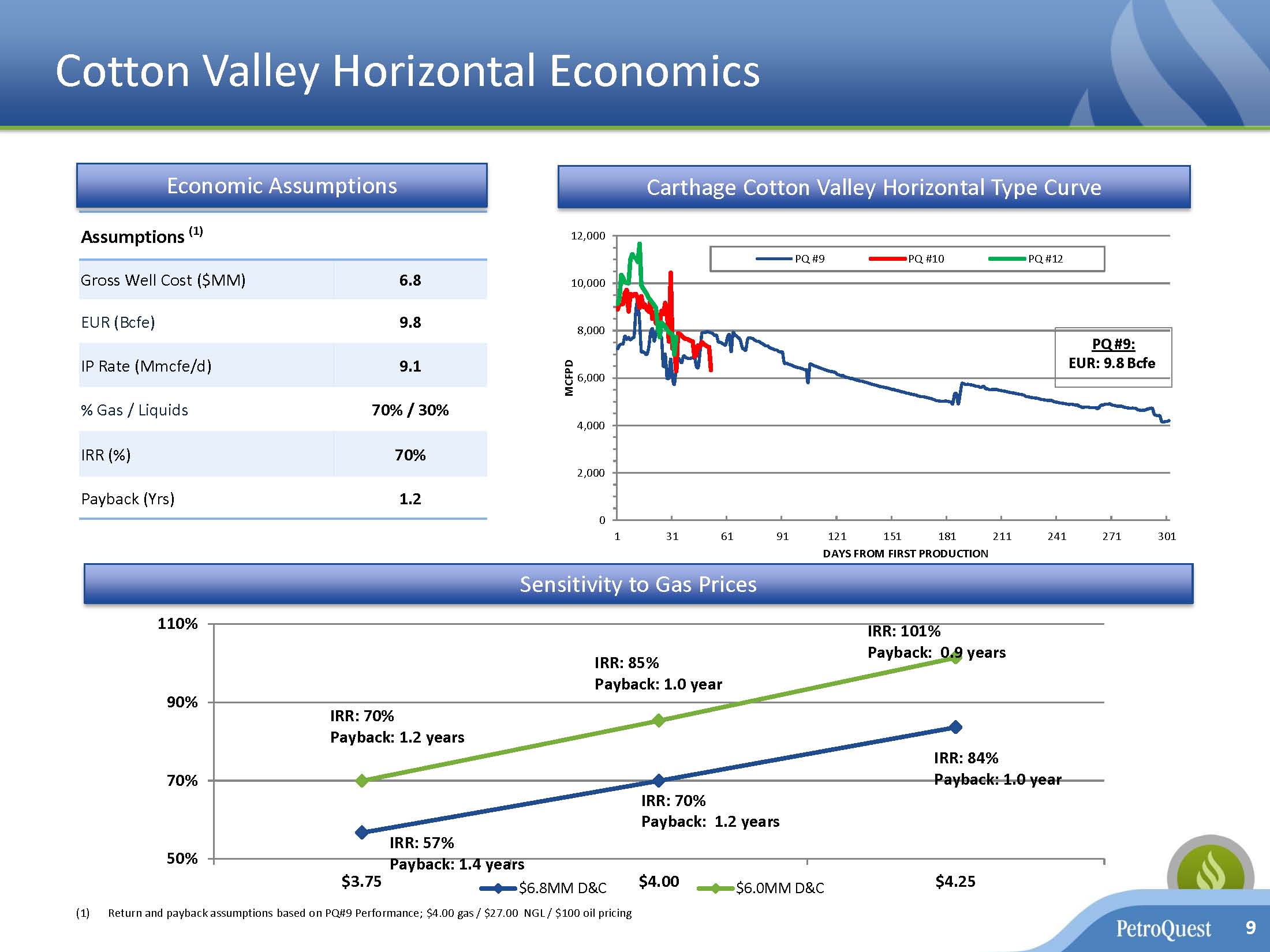

In the company’s October investor presentation, PetroQuest provides well economics for its Cotton Valley operations. At a price of $3.75 per Mcf, and a well cost of $6.8 million, PQ estimates its Internal Rate of Return (IRR) at 57%. The company estimates that its well costs will decline from $6.8 million to $6.0 million. At today’s natural gas prices ($4.25) and a well cost of $6.0 million, the IRR is 84%.

2014 Goal #2: De-risking West Relay in the Woodford

“Another 2014 goal was de-risking our 35,000 acre position and developing the West Relay field in the liquids-rich portion of the Woodford Shale. We stepped out over eight miles from North Relay Field and have now proven up and are rapidly moving our acreage into a full APP position where it can also be developed at a speed determined by the capital budget,” Goodson said.

Year-to-date PetroQuest has completed 20 wells in the Woodford and it expects to have a total of 30 wells drilled and completed in West Relay by yearend. “The West Relay wells have a much improved type curve over North Relay wells,” Goodson said. “When considering each of the nine, three- to four-well pads we drill this year requires a two-mile step out from all facilities and gathering infrastructure, one can hopefully appreciate how forecasting cannot always be an exact science. However, results are outstanding.”

Three new wells in PetroQuest’s West Relay field (average NRI – 37%) achieved an average maximum 24-hour gross rate of 2,100 Mcf of gas and 365 barrels of natural gas liquids per well. PetroQuest recently completed a four well pad (average WI – 44%) which is in the early stages of flowback.

The company plans to bring on 13 additional wells during the fourth quarter. It has two rigs running in its liquids rich West Relay field and one rig running in its Hoss field relative to its dry gas joint venture drilling program.

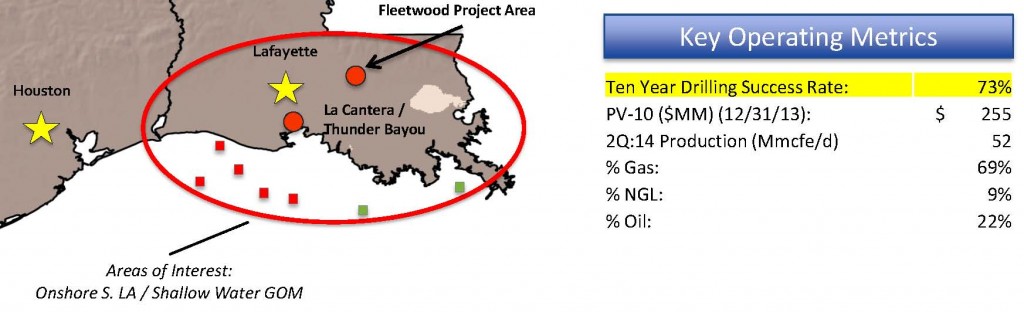

2014 Goal #3: Thunder Bayou/Gulf Coast, the Proverbial Game Changer if Successful

“Testing Thunder Bayou in 2014 and developing hopefully another very large field two miles from the La Posada facility” was PetroQuest’s third major goal for 2014, “and can very well single-handedly recharge our Gulf Coast basin high margin cash flow,” Goodson said. “However, when you consider the additions of the Fleetwood project that adds a much oilier component to our inventory, we believe the market will begin to see why we continue to be so excited about an obviously unappreciated basin.”

PetroQuest is currently drilling to depths of approximately 18,000 feet at the Thunder Bayou prospect (approximate 50% working interest). It is targeting to reach proposed total depth of 21,000 feet in Q4.

“This project offers an ideal risk/reward opportunity,” Zehnder said during the Q3 call. “For a net cost of approximately $10 million, we will expose ourselves to over 80 Bcfe of net unrisked reserve potential and if successful, an F&D of less than $0.20 per annum. If this project is successful, it will be the proverbial game changer and will significantly alter next year’s production and cash flow profile. … If the well is unsuccessful, we will have only spent approximately 5% of this year’s budget on the project.”

Production Guidance for Q4

PetroQuest Chief Financial Officer Bond Clement commented about its Q4 guidance during the conference call: “Looking at production guidance we put out yesterday, for the fourth quarter, you can see that we’re forecasting production to generally approximate the third quarter of 2014. The consistent sequential production is primarily due to continued constrained rates of La Cantera and normal production declines, offset by expected new production from our West Relay program.

“We do expect to exit 2014 at the highest daily rate of year, which should get our 2015 program off to a fast start. Based upon the midpoint of our fourth quarter guidance, we expect to achieve 15% production growth in 2014, … our highest annual production ever. Our current projections call for us to produce between 122 million and 128 million cubic feet equivalent per day for the quarter. And in total, we expect our production mix to be approximately 70% gas, 20% NGLs, and 10% oil.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.