Resolute Energy Corporation (ticker: REN), an exploration and production company based in Denver, Colorado, took a step to enhance its liquidity by selling its Hilight Field asset for $55 million.

The divesture, announced on September 16, 2015, is intended to reduce debt and will close before October 6. REN management began marketing the properties in June, and the company will have completed nearly $100 million of sales within the fiscal year once the Hilight Field divesture is closed. The company sold $42 million of non-core Permian assets in March.

Focus Remains on Core Properties

Resolute’s priorities are its position in Aneth Field and the Permian Basin, where the company began upgrading its operations in 2013. The upgrades resulted in climbing production volumes that averaged 13,528 BOEPD in Q2’15 – a company quarterly record, even though drilling operations were stood down. During that time frame, the Aneth averaged 6,307 BOEPD (95% oil) and the Permian averaged 5,566 BOEPD (54% oil), combining for approximately 88% of company volumes. Proved reserves for year-end 2014 are 68.2 MMBOE for REN’s two flagship assets, accounting for 92% of its overall reserves.

Production for the first half of 2015 is up 10% compared to 2014 even though completion spending has been reduced to approximately $10 million. Lease operating expenses have dropped by 40%, providing REN with some extra breathing room.

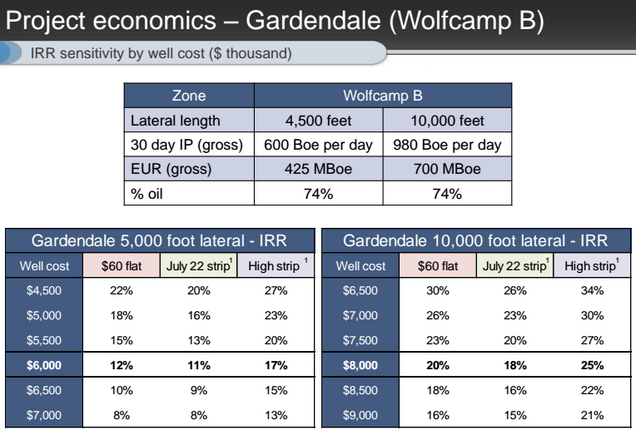

In a note covering the release, Capital One Securities said it expects Resolute to exit 2015 with roughly $180 million in liquidity, assuming the company’s borrowing base is unchanged. The firm believes a joint venture for development of REN’s Permian assets are still in the works. Its current Permian position expands 32,100 gross acres (22,100 net), with 57% classified as proved undeveloped.

Strengths: Liquids-Invested and Attractive Hedges

Resolute continues to build on a solid hedge book, with roughly 75% of its 2015 production locked in at $86 per barrel. About 75% of its 2016 volumes are hedged at about $80 per barrel, while management continues to work on layering in 2017 volumes. “We are fortunate to be in a position where our hedge book has really helped us and will help us in upcoming months and quarters,” said Nick Sutton, Chairman and Chief Executive Officer of Resolute Energy, during the company’s presentation at EnerCom’s The Oil & Gas Conference® 20.

The pace of operations is also not an issue, as 100% of its Aneth Field is held by production (HBP). About 62% of the Permian is also HBP, and the leasehold outside of that area can be extended with lease modifications. Its revolving credit line and senior notes do not mature until 2018 and 2020, respectively.