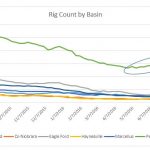

U.S. Production by Basin

Permian, Marcellus Lead U.S., while Eagle Ford Dives Hard As cost structures are held in check and oil price fluctuations are seemingly without end, producers are evaluating acreage positions and determining what are the best assets. As covered by Oil & Gas 360®, the Permian basin has been the hot bed of activity recently. With IRRs and breakeven costs in