SCOOP/STACK’s Roan Resources Points Capital Spend to Completing DUCS 1H 2019

Roan Resources, Inc. Announces Fourth Quarter Highlights and 2019 Development Program Focused on Capital Discipline and Positive Free Cash Flow by the Fourth Quarter 2019

Roan Resources, Inc. Announces Fourth Quarter Highlights and 2019 Development Program Focused on Capital Discipline and Positive Free Cash Flow by the Fourth Quarter 2019

From The Oklahoman Readers asked the Oklahoman about the potential that gross production taxes might be increased if Drew Edmondson is elected governor. The Oklahoman’s energy reporters, Adam Wilmoth and Jack Money, fielded questions during their monthly online energy chat on Tuesday. This is an edited transcript of that conversation. To see the full transcript, go to NewsOK.com. Q: I’ve heard that

Eco-Stim Energy Solutions, Inc. (ticker: ESES) reported today that it has agreed to provide its primary customer in the STACK with additional dedicated horsepower and equipment, including natural gas-powered pumping units. The company refers to this collaborative plan as a “super fleet.” According to the company’s most recent investor presentation, Eco-Stim has a total capacity of ~168,000 HHP, including 53

Alta Mesa Resources, Inc. (ticker: AMR) produced 24,000 BOEPD in Q1 2018 and exited the quarter with average net production of 25,800 BOEPD in March. Overall, total production for the first quarter of 2018 was 2,162 MBOE. According to Alta Mesa, production for 2018 is expected to average between 33 MBOEPD and 38 MBOEPD. The company added rig number eight

Newfield’s SCOOP/STACK operations pinned to future growth; Williston Basin infill projects look to deliver $100 million of free cash flow in 2018 Newfield Exploration Company (ticker: NFX) had record net production during Q1 2018, with SCOOP/STACK net production averaging 117,500 BOEPD. Newfield Chairman, President and CEO Lee Boothby said, “The Anadarko Basin is the asset that will fuel our growth

LINN Energy, Inc. (ticker: LNGG) has updated its plan to spinoff into three companies, and has provided more detail as to who will lead the branched-off companies. Riviera Resources formed, OTC ticker RVRA LINN Energy’s board has formed Riviera Resources, LLC. Riviera will hold the upstream assets in Hugoton, Michigan/Illinois, Arkoma, East Texas, North Louisiana, and Drunkards Wash, as well

Alta Mesa Resources, Inc. (ticker: AMR) and its wholly owned subsidiaries, Alta Mesa Holdings, LP (AMHLP) and Kingfisher Midstream, LLC, have released financial results, CapEx guidance and other updates. 2018 CapEx Alta Mesa’s total capital expenditures for 2018 are expected to range from $725 million to $800 million. Capital will be allocated primarily to Alta Mesa’s upstream STACK area, $550 million

Cheniere’s Midship open season ends March 30 Cheniere Energy’s (ticker: LNG) Midship Pipeline Company, LLC has signed agreements with foundation shippers to support construction of a 200 mile, 36-inch interstate natural gas pipeline project and has launched a binding open season for shippers—known as the Midship project. Cheniere said the commitments are from subsidiaries and/or affiliates of Cheniere, Devon Energy Corporation

Oklahoma’s STACK and SCOOP plays are dominated by five players – 2nd most active U.S. plays With roughly 31% of active rigs in the U.S. focusing on the Permian, it’s easy to say plays like the Delaware Basin have become the focus of the industry. Despite that, there remains a tremendous potential in the STACK and SCOOP plays, according to

BetaZi Basin Studies offer “one million petroleum engineers forecasting on each and every well” Last week, BetaZi announced that it will be offering studies on individual oil and gas basins in the U.S.. For every well in the covered basins, BetaZi includes the company’s oil and gas production forecasts, associated type curves, pScores, first-pass economics and Tobin well data. BetaZi

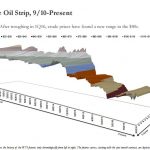

Permian, SCOOP/STACK in favor Baird’s energy research team presented the results of the firm’s 3Q16 Energy Strategy Survey in a conference call today that was hosted by Denver-based senior analyst Ethan Bellamy and New York-based senior analyst Dan Katzenberg. This was the firm’s 14th energy survey since June of 2013. The Q3 survey set a participation record with 182 respondents, including

Pioneer Energy Services presents at EnerCom’s The Oil & Gas Conference® During Pioneer Energy Services’ breakout session, management was asked the following questions: What do you think the state of the industry really is? What type of rigs will get the best utilization going forward? Do you see competition from walking converted SCR rigs? How are you doing on crews?

Sign up to receive daily news and stock prices from Oil & Gas 360® directly in your email inbox.

Market Data ©2020–2024 QuoteMedia. Data delayed 15 minutes unless otherwise indicated (view delay times for all exchanges). RT=Real-Time, EOD=End of Day, PD=Previous Day. Market Data powered by QuoteMedia. Terms of Use.