In Part II of this exclusive interview for Oil & Gas 360®’s “Top Minds in the Business” series, legendary oil man Bill Barrett shares his company growth structure, similarities in downturns and the long-term potential for newcomers in the oil and gas industry.

Oil & Gas 360® spoke to Bill Barrett from his home in Denver regarding the past and present of the oil and gas industry.Bill Barrett is a legendary oil man in the Rocky Mountains who is known worldwide for creating successful companies, unearthing discoveries and creating prosperity from exploration. Mr. Barrett’s accomplishments include being presented with Outstanding Explorer and Lifetime Achievement Awards by industry associations including the American Association of Petroleum Geologists. He was honored with two of the highest awards by the Independent Petroleum Association of Mountain States, receiving the Wildcatter of the Year in 1993 and being inducted into the Hall of Fame in 2003.

What was your particular secret to success—what do you see as the key to building a successful oil and gas company?

BILL BARRETT: When we started Barrett Resources in 1981, we were very small. We were only worth a couple million dollars. So we basically put prospects together and sold them to the industry, and when you’re doing that you have to get some pretty good prospects.

We didn’t want to take on any debt. We didn’t believe in it. That will kill you if you ever have a downturn. So we always figured out what we could afford to keep.

When we sold a prospect, we always tried to get our money back, make a profit, or get paid by an overriding royalty that carried working interest. But we always used other people’s money to drill the more high-risk exploration type wells, and those are usually the first wells you drill on the prospect. If the well was successful we would then join in the lower risk development wells. So we only participated in what we could afford to pay in cash or where we could get a carry.

We’d start out with a 1/8 interest, and as we grew we would increase it to ¼ interest and as we got bigger, we could keep up to ½. Then pretty soon we could retain as large of an interest as we wanted to. We always brought in partners for the high-risk exploration projects in order to get a carry on the high risk wildcat wells. So that’s how we grew the company.

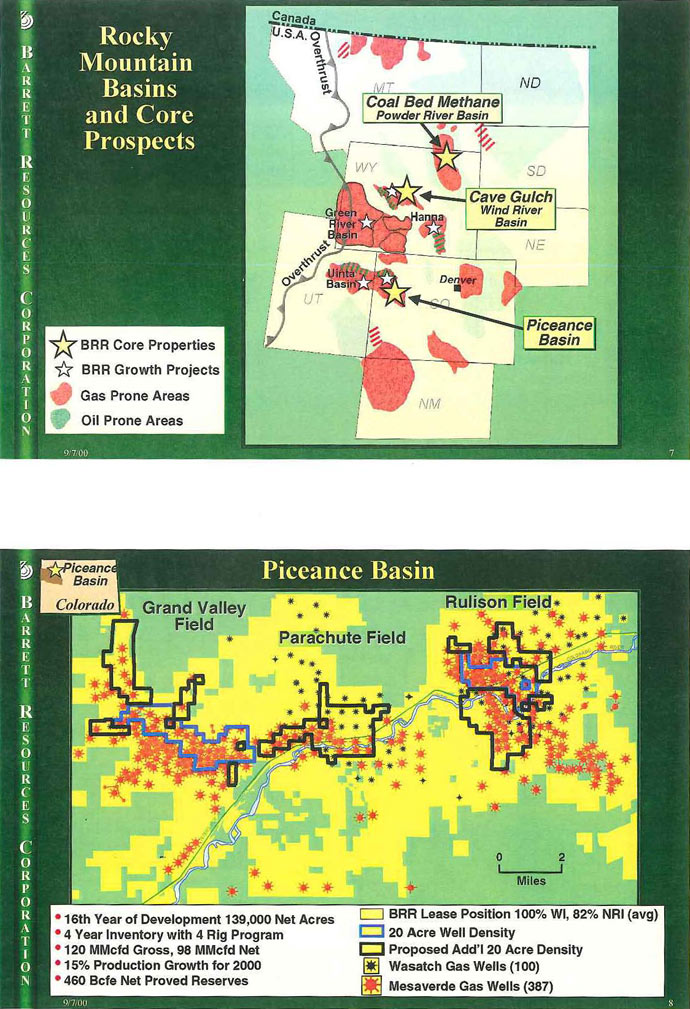

So we did get involved in acquisitions but generally we only acquired properties in and around our existing development. In the Piceance, we bought out all of our partners. We bought an adjacent field from Williams, so we would do acquisitions but they had to very specifically enhance the properties we already had in our pocket. That was our growth strategy. It’s very important for a team to maintain financial liquidity and not incur too much debt, because some of the very best opportunities in our business become available when we have downturns like we did back in 1986—and like we’re experiencing today.

So we did get involved in acquisitions but generally we only acquired properties in and around our existing development. In the Piceance, we bought out all of our partners. We bought an adjacent field from Williams, so we would do acquisitions but they had to very specifically enhance the properties we already had in our pocket. That was our growth strategy. It’s very important for a team to maintain financial liquidity and not incur too much debt, because some of the very best opportunities in our business become available when we have downturns like we did back in 1986—and like we’re experiencing today.

The old cliché is “When there’s blood in the street, it’s a good time to take advantage of existing opportunities.” But that’s why it’s important to have dry powder available to take advantage of the opportunities when they come along. I always stress the importance of having financial liquidity. Back in 1981 when we started Barrett Resources there were a lot of new public companies. And by 1986, 70% to 80% of those companies were gone. Why? It’s primarily because they got into cash flow problems. When the bottom drops out of the price, your cash flow goes down, and if you’re servicing debt, you’re screwed.

OAG360: What other similarities do you see between the 1980s and today?

BILL BARRETT: There’s a lot of similarity today. There have been several downturns, but some are deeper. I went through plenty in my 60 years in the industry, and there was one in 1998, and the one in 1986 was pretty bad.

But when a downturn comes, you always feel bad because you know there’s going to be staff cuts and companies will focus on the more economic projects and cut budgets, etc. We never had to do that in the companies I was involved in. If you don’t carry debt you won’t get in that kind of trouble.

When we were trying to grow the company, the down cycles gave us the opportunity to do it. There’s going to be a huge amount of opportunity because of the effects of this price environment today, so the people who have dry powder or available cash will be able to take advantage of the opportunities that come to them. But the flip side is that companies who took on a lot of debt will have to worry about staying alive instead of being able to jump on new opportunities.

OAG360: What advice would you give young people going into the business?

It’s still going to be a very good industry. It’s going to be tougher right now, but when you go through down cycles you learn a lot.

A lot of these young guys haven’t been through these situations and it spooks the hell out of them. I remember being in their position and it spooked the hell out of me.

But with the evolution of fracing technology, the industry is still in the early stages of development. There’s still a huge opportunity and there’s going to be development for the next 40 years out here. So the energy business is going to continue to be a really good business to be in.

I have a lot of friends who jumped out during down cycles, but I didn’t. It is a cyclical business so you’re going to go through these ups and downs, but the important thing to learn is that you have to stay lean and mean and not take on too much debt. Make sure your production is appropriately hedged, and always try to maintain sufficient liquidity so you’re ready when an opportunity walks in your door.

A lot of companies don’t do that. They get caught up in developing, and they don’t realize that things won’t last forever if the market hits a downturn.

It is my belief that this particular downturn is not going to be as severe. Oil prices could certainly drop more, below $40 maybe, but I don’t think it would stay there for long. The world population is still growing and there’s always a need for energy, and in the long haul, the energy will be developed. It’s a great industry to be involved in, but you have to have some staying power and not get too spooked in the tough times.

OAG360: Do you have any regrets?

BILL BARRETT: If I had to do it over again I would do the same thing. I love the chase. The thrill of exploration. However, I did not like the environmental and regulatory hoops you have to jump through. It got to where I was spending 70% of my time on those issues near the end of my career.

When we first started in the oil business, we were trying to find federal acreage to drill, but by the end of my career we were trying to avoid it entirely, because it was such a hassle.

**OAG360 offers our sincerest thanks to Mr. Barrett for the time he spent on this series**