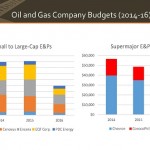

Borrowing Base Availability by Company

How Much Borrowing Base will be Left after Redeterminations? Bankruptcy and restructuring have become prevalent words in the oil and gas industry during the present price downturn. With spring borrowing base redeterminations already under way or quickly approaching, speculation is rampant as to the extent of cuts and who will suffer the consequences when cuts are made. Oil & Gas